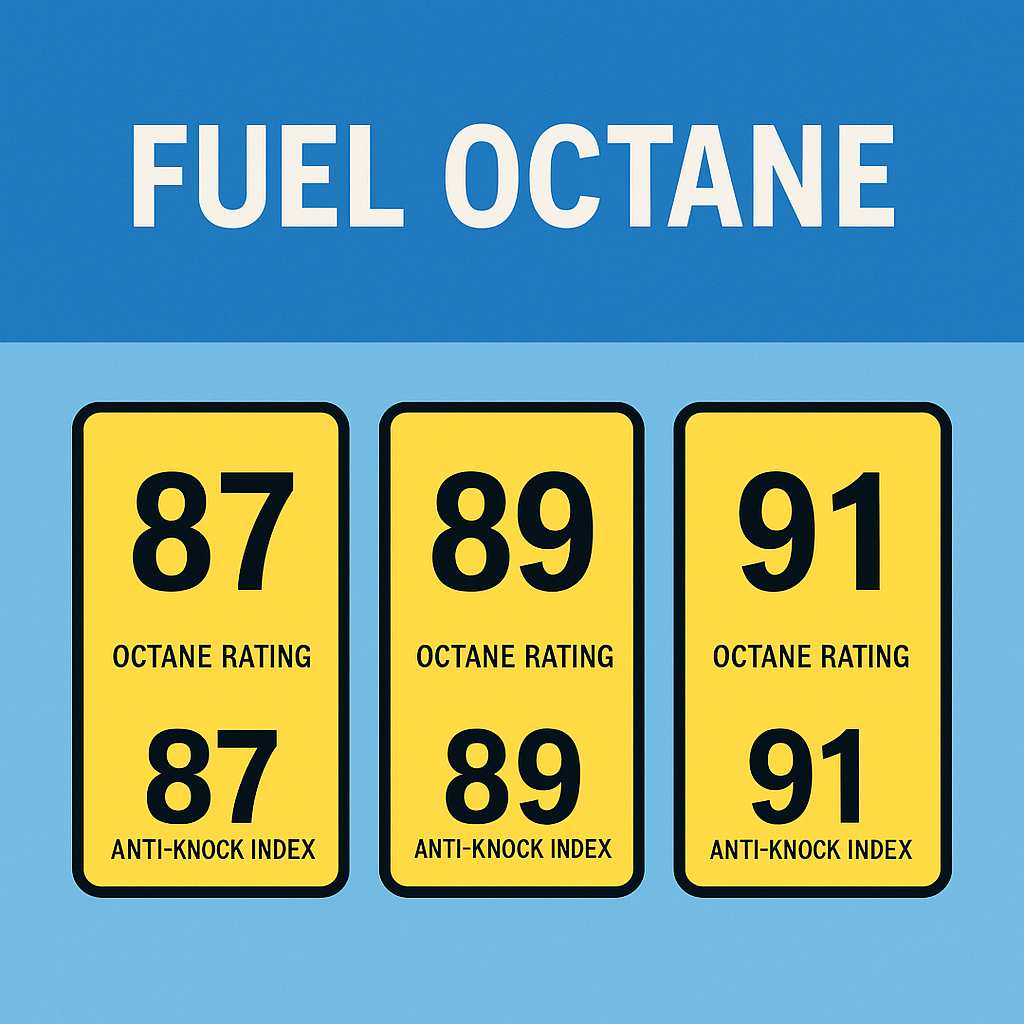

At every gas station, drivers are faced with a decision: Regular, Mid-Grade, or Premium? These choices—usually labeled by their octane ratings such as 87, 89, and 91 or 93—are more than just pricing tiers. They represent different formulations of gasoline that affect how your engine performs and how efficiently it combusts fuel. But with higher prices attached to premium fuel, a common question arises: is it really necessary for your car?

To answer that question, you must first understand what octane rating actually means and how it impacts your engine.

What Is Octane?

Octane is a measure of a fuel’s ability to resist “knocking” or “pinging” during combustion. Knocking occurs when the air-fuel mixture in an engine’s cylinder ignites prematurely or unevenly. This causes a sharp knocking noise and can lead to engine damage over time. The higher the octane number, the more compression the fuel can withstand before igniting. Essentially, a higher octane fuel is more stable under pressure and resists pre-ignition better than a lower octane fuel.

Gasoline’s octane number refers to its resistance to this detonation:

-

87 Octane: Regular Unleaded

-

89 Octane: Mid-Grade or Plus

-

91-93 Octane: Premium Unleaded

Note: Some regions label premium as 91, others as 93, depending on availability and local fuel formulations.

How Octane Affects Your Engine

The octane rating your car requires depends on your engine’s compression ratio, design, and whether it uses forced induction systems like turbochargers or superchargers.

-

High-Compression Engines: These engines compress the air-fuel mixture more tightly, which creates more power but also increases the risk of premature combustion. These engines typically require higher-octane fuel to operate safely.

-

Turbocharged or Supercharged Engines: Because these systems force additional air into the engine, they increase cylinder pressure, which raises the risk of knock. Manufacturers of such vehicles often recommend or require premium fuel.

-

Standard Engines (Low to Medium Compression): These engines are designed to run efficiently on 87 octane, and using higher-octane fuel offers little to no benefit in terms of performance or efficiency.

Does Higher Octane Improve Performance?

One of the biggest myths is that premium fuel improves performance in all vehicles. In truth, using a higher octane fuel than your car requires does not enhance power, improve fuel economy, or clean your engine better—unless your engine is specifically tuned to take advantage of the higher octane. High-performance vehicles may respond better with premium because their engine management systems adjust spark timing and fuel delivery based on octane levels. But for the average car designed for 87 octane, premium gas provides no extra value aside from draining your wallet faster.

When You Should Use Premium

You should use premium fuel if:

-

Your owner’s manual says “required” or “only” premium fuel. This is often the case for luxury or performance vehicles. Ignoring this recommendation can result in reduced engine performance, lower fuel efficiency, and even long-term damage.

-

You experience knocking or pinging with regular fuel. This may indicate your engine is sensitive to lower-octane fuel, or your driving conditions (high heat, towing, uphill climbs) are increasing pressure inside the combustion chambers.

-

You’ve had your car tuned or modified. Aftermarket ECU (engine control unit) tuning, turbo upgrades, or increased compression often necessitate higher octane to prevent knock.

When Premium Is Optional or Unnecessary

If your owner’s manual says “premium recommended,” you can generally use regular fuel without immediate harm. You might see a slight drop in horsepower or mileage—often barely noticeable—but you won’t be causing engine damage.

For vehicles that specifically state 87 octane is required, using 91 or 93 is not just unnecessary—it’s wasteful. The computer won’t advance timing enough to make use of the higher octane, so you’re essentially paying more for no gain.

Special Note on Ethanol and “Top Tier” Gas

Another factor to consider is ethanol content. Most gasoline in the U.S. contains up to 10% ethanol (E10), which helps with cleaner combustion but has slightly less energy than pure gasoline. Some vehicles are designed for flex-fuel (E85), which is 85% ethanol and requires a completely different fuel system.

“Top Tier” fuel refers to gas that contains extra detergents and additives to help keep your engine clean. This is different from octane rating and is worth considering if you want to maintain long-term engine health, especially for direct-injection engines prone to carbon buildup.

Octane Misconceptions

-

Higher octane means more power: Only in cars that require it.

-

Premium gas cleans your engine: Detergents in fuel do that, not octane.

-

You should switch to premium as your car ages: Not necessarily. Unless your engine is knocking, stick with your manufacturer’s recommendation.

Bottom Line: What Should You Use?

-

Check your owner’s manual. This is your definitive guide. If it says 87, use 87.

-

Listen to your engine. If you hear knocking, consider using higher octane temporarily and have it checked by a mechanic.

-

Don’t waste money on premium unless your vehicle requires it. There’s no “extra boost” unless your car can use it.

Final Thoughts

Fuel octane isn’t just about price—it’s about compatibility. Using the right octane ensures your engine runs efficiently, safely, and within its design limits. While premium gas has its place in high-performance and luxury vehicles, for the average driver in a standard vehicle, regular 87 octane is more than enough. Understanding the science behind octane—and how it fits into your vehicle’s needs—will not only protect your engine but save you money every time you fill up.